How I d Approach General Assembly Again as a Vc

As a decade of growth in venture capital investment falters amid uncertain economic weather condition, ane thing remains abiding: VCs will proceed searching for companies that exercise business in a way that'due south never been done earlier.

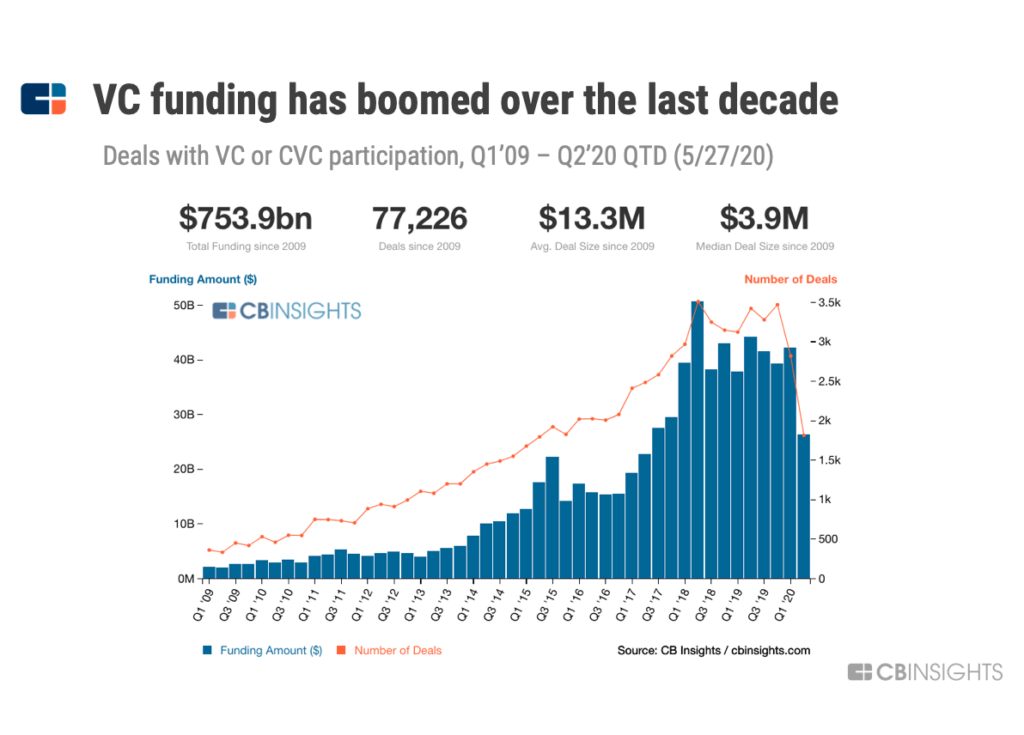

Venture capital letter has experienced a boom over the past decade.

Fueled by billion-dollar exits, the explosion of Silicon Valley startups, and massive raises from SoftBank's $100B Vision Fund, annual uppercase invested worldwide increased by near 13x from 2010 to 2019 to achieve over $160B. Meanwhile, mega-rounds (investments of $100M+) nearly tripled from 2016 to 2018.

Notwithstanding, the economic downturn brought on past Covid-19 has to some extent put the brakes on that growth. Fewer VCs are investing in seed-stage startups, and March 2020 saw a 22% year-over-yr (YoY) decline in overall VC deals in the Us.

It's likely that VCs are existence more selective in their investments, preferring more established companies that have proven themselves to be potent plenty to conditions the pandemic and grow when the economy ramps support.

But venture capital is in many ways resistant to brusque-term changes, due to the elementary fact that venture investments are long-term. VCs aren't necessarily looking to invest in startups that volition see huge growth in the immediate future; they are looking for ones that will grow into something extraordinary 10 years from now.

Overall, the fundamentals of venture capital haven't inverse. VCs place their bets on startups poised to spring-offset a fundamental modify in consumer or business organisation behavior — and this fact is no different now than it was when the industry began.

In this report, we explore the foundations of venture capital by diving into its key terms and definitions, the motivations and idea processes of VCs, and what VCs — and startups — look for at each investment stage.

Table of contents

What is venture capital?

- A game of home runs

- Why startups seek VC funding

The VC food concatenation

- Who are LPs?

- LPs to VCs

- VCs to startups

- VCs to VCs

The venture bargain

- How VCs source deals

- Tips and sources

- Inbound deals

- How VCs select investments

- Market size

- Production

- Founding squad

- The term sheet

- Valuation

- Pro rata rights

- Liquidation preference

The venture upper-case letter financing bicycle: seed to exit

- Seed phase

- Series A

- Series B

- Series C

- Late phase

- Leave

What is venture capital?

Venture uppercase is a financing tool for companies and an investment vehicle for institutional investors and wealthy individuals. In other words, it's a manner for companies to receive money in the short term and for investors to abound wealth in the long term.

VC firms raise capital from investors to create venture funds, which are used to purchase equity in early- or late-stage companies, depending on the firm's specialization (although some VCs are stage-agnostic). These investments are locked in until a liquidity result, such equally when the company is acquired or goes public, at which point VCs realize profits from their initial investment.

Venture capital is characterized by loftier gamble, merely also high reward. On the i paw, VCs must invest in emerging technologies and products that have massive potential to scale, only aren't assisting withal — and over two-thirds of VC-backed startups fail. At the same fourth dimension, VC investments can prove to be enormously assisting, depending on how successful a portfolio startup is.

For example, in 2005, Accel Partners invested $12.7M in Facebook for a ~10% equity pale. The house sold a part of its shares in 2010 for around half a billion dollars, and went on to make over $9B when the visitor went public in 2012.

Mark Zuckerberg, Sheryl Sandberg, and Accel Partners partner Jim Breyer. Source: Jim Breyer via Medium

Another of import characteristic of venture capital is that most investments are long-term. Startups oft take 5 to 10 years to mature, and whatever money invested in a startup is difficult to pull out until the startup is robust enough to concenter buyers in the mergers & acquisitions, secondary, or public markets. Venture funds have a 10-year lifetime, and then VCs can see through these investments without the pressure to demonstrate short-term gains.

On the company side of VC transactions, venture capital allows startups to finance their operations without taking on the burden of debt. Because startups pay for venture capital in the form of shares, they don't have to incur debt on their rest sheets or pay the money back. For startups looking to grow rapidly, venture uppercase is an attractive financing option, potentially allowing startups to outpace the competition as they take in more than investments at each growth phase.

Startups also take on venture uppercase to tap into VCs' expertise, networks, and resources. VCs frequently have a wide network of investors and talent in the markets they operate in, equally well as years of experience overseeing the growth of many startups. The mentorship VCs can bring is especially valuable for first-time founders.

Today, venture capital is most active in the B2C software, B2B software, life sciences, and straight-to-consumer (D2C) industries. The software industry is fertile grounds for VC investment because of its low up-front end costs and huge addressable market. Companies similar Google, Twitter, and Slack have risen to dominance thanks in part to venture financing.

The life sciences sector, while a more capital letter-intensive area for companies to start out in, also offers a behemothic addressable market and technological and regulatory moats to protect against competition. The sector is also attracting increased attending during the coronavirus pandemic.

The D2C industry has also been a big focus for VC funding, with companies similar Warby Parker delivering affordable, well-made products at calibration through online channels.

A game of domicile runs

Until 1964, Babe Ruth held the record for the near career strikeouts, at 1,330. Despite that, he also hitting 714 home runs in his career, giving him the highest slugging percentage of all fourth dimension. When Babe Ruth went to bat, he swung for the fences.

VCs espouse a similar strategy. By taking stakes in companies that take a pocket-size chance of becoming enormous, they make investments that tend to be either habitation runs or strikeouts. Chris Dixon, a general partner at Andreessen Horowitz, calls this the Babe Ruth Effect.

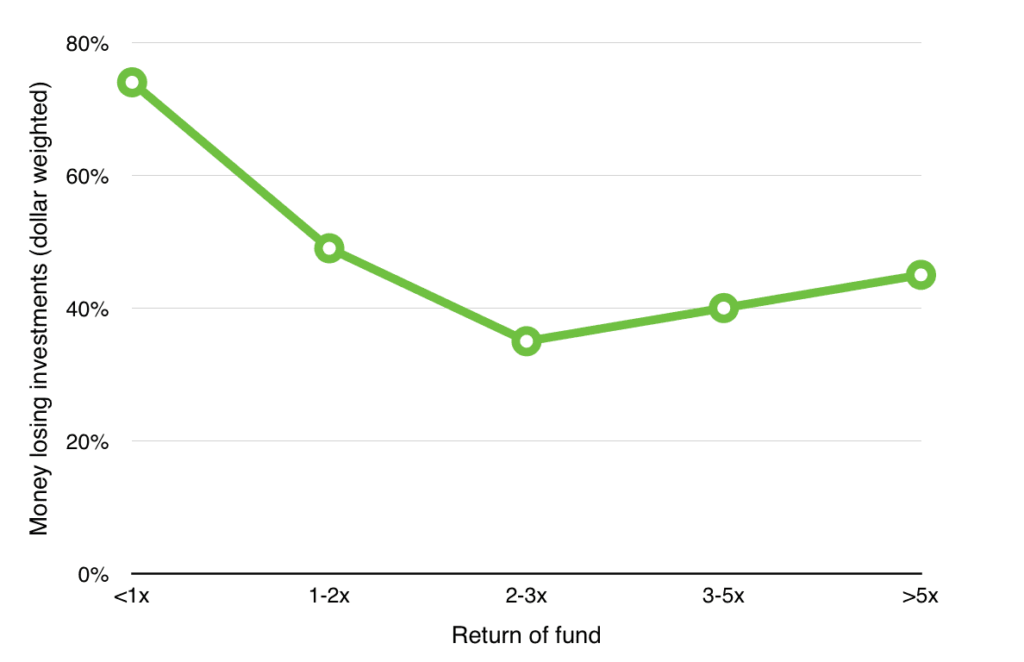

According to Dixon, cracking funds with a 5x or greater return rate tend to have more than failed investments than good funds with 2-3x returns. In other words, groovy VCs are bigger risk-takers than good VCs: They make fewer bets on "safe" startups that do fairly well, and more bets on startups that will either bomb or transform the manufacture.

Source: Chris Dixon

These great funds also take more habitation-run investments (investments that return more than 10x) and fifty-fifty domicile runs of greater magnitude (returning around 70x).

This is why Peter Thiel, an early investor in Facebook, looks for companies that create new engineering, rather than companies that replicate something that already exists. He observes that these new technologies enable "vertical progress," where something is transformed from "0 to one."

He cautions against "horizontal" or "1 to north" progress: taking an existing technology and spreading it elsewhere, such as by recreating a service in a new geographic location.

That said, many VCs do ride on trends and invest in incremental companies. 1 reason for this is that the reputational price of failing on a contrarian bet is high: If a fund flops, its investors might be more forgiving of investments that were widely thought to be the next big thing.

Why startups seek VC funding

Generally speaking, bankers do not lend to startups the way they may offering traditional loans to other businesses (e.g. agreements where the borrower agrees to pay back a principal, plus a set level of interest).

Banks rely on fiscal models, income statements, and balance sheets to determine whether a business concern qualifies for a loan — documents that aren't equally useful when gauging an early-stage startup's value. Furthermore, in the early stages, at that place is hardly anything for banks to hedge every bit collateral. Whereas an established visitor may take factories, equipment, and patents, which a bank could accept in the event of a foreclosure, a software startup might exit backside a few laptops and office chairs.

VC firms are amend attuned to evaluating early-stage startups, using metrics that go beyond fiscal statements — such as product, market place-size estimates, and the startup's founding team.

These tools are by no means perfect, and most investments will lose their value. All the same, considering equity returns are uncapped, the high take a chance of investing in startups tin can be justified. While debts are structured and so that a lender can just recuperate the principal and a set corporeality of interest, equity-based financing is structured so that in that location is no upper limit to how much an investor can earn.

Broadly, the equity financing model has served the startup ecosystem well. Startups can advance growth without slowing down to pay downward debt, as they would with a traditional business loan, and VCs tin can capitalize on the rapid growth of startups upon their exits.

Even so, giving out disinterestedness in exchange does carry 2 principal liabilities for companies: loss of upside and loss of control.

Because equity is partial ownership of the company, investors are paid a percentage share of the full toll of the acquisition or IPO when the company exits. The more disinterestedness a startup gives out, the less is left for founders and employees. And if the company grows extremely valuable, the founding members may end upward missing out on a much greater amount than what they would accept paid if they had taken on regular debt financing, rather than equity funding.

Giving out disinterestedness can likewise hateful ceding control. VCs go shareholders, often sitting as board members. They may utilize pressure to important business decisions, from when products launch to how the company exits. Because VCs need big exits to boost their overall fund performance, they may even urge decisions that lower the risk of moderate success, while increasing the odds that the startup, if successful, returns 100x.

The venture upper-case letter nutrient chain

VCs raise their money from limited partners (LPs), institutional investors who serve the interests of their client organizations.

The interests and incentives of LPs greatly influence VCs' investment strategies. This department will examine the menstruation of influence and relationships across the chain, from the LPs' institutions to the VC-backed startups.

Who are LPs?

LPs are typically big institutional investors, such equally academy endowments, pension funds, insurance companies, and nonprofit foundations. (Some LPs are wealthy individuals and family offices.) They can manage upwardly to tens of billions of dollars, which they invest in diversified portfolios.

An LP's portfolio must serve the needs of the establishment by growing its asset base year-over-yr, while also funding expenses of the establishment.

For case, Harvard's endowment funds a large portion of the schoolhouse's annual functioning. If its $40B+ endowment grows at 5% annually, simply the university'southward expenses on average cost 6% of the endowment, the asset base will shrink by 1% every year. A weakening endowment tin can endanger the institution's standing and hamper its power to hire the all-time professors, attract top students, and fund leading enquiry.

Similarly, alimony funds are responsible for funding pensioners' retirements; insurance visitor reserves are responsible for payouts; and nonprofit foundation reserves are responsible for financing their organizations' grants.

As LPs manage take a chance and grow their asset base of operations at a sustainable rate, venture upper-case letter'southward role in their portfolio is to (hopefully) produce the investment'due south blastoff — backlog returns relative to a benchmark index.

LPs to VCs

LPs invest in venture capital by pledging a sure corporeality in VC funds. The size of these funds can range from $50M to, in some cases, billions.

Over the past few years, greater influxes of capital into VC firms have led to the rise of $1B+ mega-funds and an increased number of sub-$100M micro-funds.

In 2018, for example, Sequoia Capital raised $8B for its Global Growth Fund Iii, $i.5B of which it has dispersed in 15 growth-stage startups (as of January 2020). The fund's largest investment and so far was $384M to Communist china-based Bytedance, the TikTok parent visitor.

On the other finish of the spectrum, Catapult Ventures raised a $55M fund in 2019 that targets seed-phase startups specializing in AI, automation, and cyberspace of things (IoT). In April 2020, the firm participated in a $3.3M seed round for Strella Biotechnology, a visitor that optimizes supply chains for fresh produce.

VCs raise capital from LPs by pitching their track record, projections into the fund'south operation, and hypotheses on promising areas of growth.

Fundraising can accept a long time, so VCs will often do a "first close" afterward hit 25-50% of the target amount and then start investing those funds before the final close.

About funds have a 2-20 structure: 2% management fee and twenty% carry. The 2% fee covers the firm'southward operating expenses — employee salaries, hire, day-to-day operations.

The "conduct," meanwhile, is the essence of VC compensation — VCs take 20% of the turn a profit their funds make. While investing in a potential Google or Facebook can generate more than than enough profit to go effectually for both VCs and their LPs, a 20% behave can become a hurting point for LPs when a VC delivers thin margins.

In render for high fees, high risk, and long-term illiquidity, LPs look VCs to evangelize marketplace-beating returns. By and large speaking, they expect VCs to return 500 to 800 footing points higher than the index. For example, if the S&P 500 returned vii% annually, LPs would await venture capital to return at to the lowest degree 12%.

The college a VCs' returns, the more prestige the firm gains. Some of the well-nigh well-known funds include:

- Andreessen Horowitz's Andreessen Fund I, which performed in the top 5% of funds raised in 2009, with a 2.6x return on investment (ROI)

- Sequoia Capital letter'due south 2003 and 2006 funds, which brought 8x in returns, internet of fees

- Benchmark's 2011 fund, which carried 11x in returns, net of fees

If VCs fail to deliver market place-chirapsia returns or fifty-fifty lose LPs' money, their reputation takes a hit, making it difficult to raise new funds to cover expenses. To stay in business concern, VCs need to invest in high-performing startups that yield returns that will go on their LPs happy, while still leaving the fund with a generous comport to have dwelling.

VCs to startups

For VC funds to yield market-beating rates of returns, VCs need companies that return 10 to 100 times their investment.

Because 67% of VC-backed startups fail, and in that location is only a slim chance — at most ane.28% — of a billion-dollar company being created, VCs need startups that return astronomically to make up for the inevitable failures.

A closer expect at how VC returns are distributed demonstrates how extremely disproportionate investment functioning is across VC-backed startups.

VC returns follow a power-law curve: one quantity varies with the power of another. This means the highest performer has exponentially greater returns compared to the 2nd highest, and and then on.

Every bit a result, distribution is heavily skewed, with a few meridian investments bringing in the lion's share of the returns. (The rest, chosen the "long tail," generate just a fraction.)

The cost of missing an investment at the high-render end is enormous, while netting one has the potential to return the fund many times over, even if the rest of the portfolio flounders.

What keeps VCs upwards at nighttime isn't the portfolio companies that go bust — it's the wildly successful ones that got away.

VCs to VCs

The VC industry as a whole follows the power-law curve, just as VC investments do.

In other words, funds managed by a few aristocracy firms generate most of the wealth, and the long tail is littered with funds that don't make the manufacture average charge per unit of return.

Top investment opportunities are scarce. While in that location may be more financing rounds, in that location is but 1 Facebook Series A round. Once that window closes, it's closed for good: There's no mode to invest under the aforementioned terms and conditions.

VCs compete with one another to get a seat at the table in these highly sought-out rounds, where the lead investor is usually an elite firm, such equally Sequoia Capital, Accel Partners, or Kleiner Perkins.

The venture deal

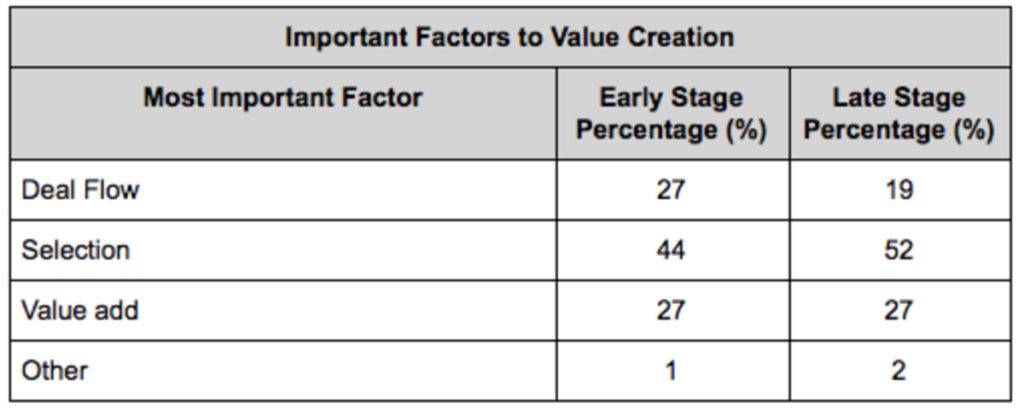

Because of the Babe Ruth Effect, closing the right deal is the most important activeness a VC does. In a survey of nearly 900 early on- and tardily-stage VCs, deal menstruum and selection together were reported to make up about 71% of the value VCs create.

Source: Antoine Buteau via Medium

No amount of mentorship or cash can transform a mediocre company into the adjacent Google. That's why VCs spend the bulk of their fourth dimension and effort gaining admission to the all-time deals, evaluating and selecting their investments, and hammering out the details in the term canvas (more than on this below).

How VCs source deals

Steady access to loftier-quality deals is crucial for a VC to succeed. Without healthy deal flow, a VC tin can miss out on high-profile investment rounds and fail to notice high-potential startups in their infancy. Each time a VC fails in this regard, its fund is at chance of underperforming against the competition.

Therefore, VCs volition go to keen lengths to ameliorate the quality of their deal flow. Successful VCs have a strong network that helps them capture investment opportunities, also as a stiff brand that generates a steady stream of entering deals.

Tips and sources

A rich and various network is frequently a VC'south best source of deals. VCs rely on their network to connect to promising founders whose startups fit the investment thesis.

Firstly, VCs network with one another by investing jointly in companies, sitting on boards together, and attending industry events. VCs will often invite others in their network to investment rounds or refer startups that aren't a friction match to their firm.

VC firms besides rely on a professional person network of entrepreneurs, investment bankers, Thousand&A lawyers, LPs, and others they've worked with in growing and selling startups.

Accelerators — which offer a kind of entrepreneurship boot camp for founders — also maintain shut relationships with VCs, often becoming joint investors. In 2009, Paul Graham of accelerator Y Combinator tried to loop Fred Wilson of Spousal relationship Square Ventures into investing with him in Airbnb — and Wilson famously declined.

Lastly, MBA programs and university entrepreneurship centers are besides expert deal sources for VCs. One example is DoorDash, which started every bit a Stanford Business School project, and went on to raise more than $2B of uppercase and be valued at nearly $13B.

If there isn't a adept span in their network to connect with a promising startup, however, VCs will resort to the tried-and-true method of common cold emails to limited interest in partnering.

Entering deals

Building a robust network isn't plenty for a VC to proceeds maximum exposure to the highest-quality deals. Given the scarcity of unicorn startups and the intensity of competition, VCs need to build a strong brand to improve the flow of entering deals.

There are largely two ways in which VCs differentiate their brand and offerings: thought leadership marketing and "value-add" services.

Past becoming idea leaders, VCs concenter a community of entrepreneurs and other investors that expect to them for expertise and authority. VCs build their platforms by writing, blogging, tweeting, and speaking publicly at various events.

Commencement Round Capital letter publishes long-form articles on leadership, management, and teamwork for early on-stage entrepreneurs. Fred Wilson of Matrimony Foursquare Ventures has run a daily blog since 2003 where he shares various behind-the-scenes insights into the industry. Bedrock Majuscule brands itself as a business firm that discovers "narrative violations" — companies challenging a commonly accepted narrative.

Pairing thought leadership expertise with an enticing "value-add" service tin can be a powerful way to lure top startups. VCs add value to their portfolio companies beyond just offering capital; they deliver mentorship, network, and technical support.

Andreessen Horowitz provides its companies with a full-stack marketing and accounting service. GV, the VC arm of Alphabet, has an operations squad dedicated to helping startups with product design and marketing. First Round Capital holds leadership conferences and mentorship programs specifically geared toward early-stage founders, offering a community of relationships beyond but the firm itself.

How VCs select investments

Evaluating a startup presents a unique challenge. Often, in that location aren't comparable businesses, authentic market-size estimates, or predictable models. Every bit a result, VCs rely on a mix of intuition and data to assess whether the startup is worth investing in and how much information technology should exist valued at.

Market size

VCs chase later on opportunities with a big full addressable market place (TAM). If the TAM is minor, there is a limit to the returns the VC can reap when the company exits — which is no good for VCs that need companies exiting at 10-100x in order to be recognized as i of the elites.

Merely VCs don't only want to invest in companies situated within large addressable markets from the beginning. They too want to bet on companies that grow their addressable markets over time.

Uber'due south TAM grew 70x over x years, from a $4B black-motorcar market to a well-nigh $300B cab and automobile buying market. As the product matured, its cheaper, more convenient service converted customers, starting a network effect in which costs decreased as ride availability increased.

Pecker Gurley, general partner at Criterion (which has invested in Uber), sees the company eventually taking on the entire auto market, as ride hailing becomes preferable to owning a car.

Another example is Airbnb, which started in 2009 as a burrow-surfing website for college students. At the fourth dimension, its own pitch deck told investors that there were just 630,000 global listings on couchsurfing.com. But by 2017, Airbnb had 4M listings — more than rooms than the five biggest hotel groups combined. Its TAM had grown with it.

Information technology'southward challenging to predict the magnitude of the impact a product will accept on its market place. According to Scott Kupor, managing partner at Andreessen Horowitz and author of "Secrets of Sand Hill Road," VCs must be able to "retrieve creatively near the role of applied science in developing new markets" to seize corking investments, rather than take TAM at face value.

Product

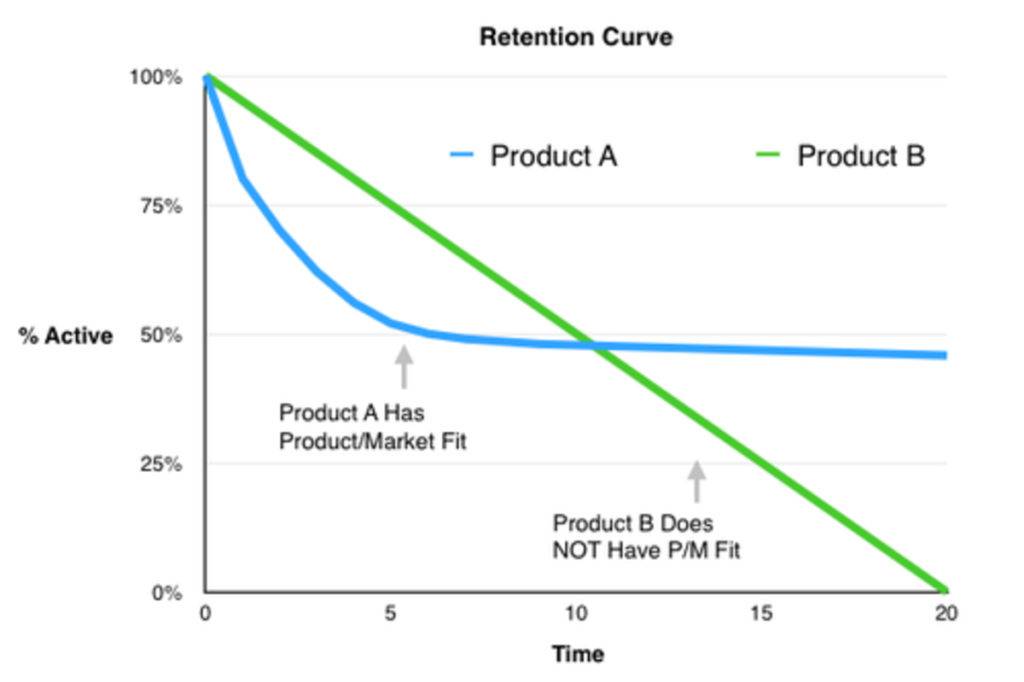

Another key consideration is product-market fit, a nebulous idea that refers to the indicate when a product sufficiently meets a need in a marketplace, such that adoption grows rapidly, while churn remains low. The majority of startups fail because they don't discover product-marketplace fit, which is why many venture capitalists agree that it is the most important goal for an early on-phase company.

There isn't a particular point at which product-market fit occurs; rather, it happens through a gradual process that could take from several months to several years. Neither is information technology permanent once it's reached: Customer expectations are constantly changing, and products that once had strong product-market place fit can fall out of it without proper adjustments.

It's also of import to sympathize that product-market fit doesn't equate to growth. A spike in usage driven by early adopters may look impressive on a dashboard, but if the numbers drop off in a few weeks, it's non a adept indicator of production-market place fit.

Founders have gone to extreme lengths to nail product-market fit, from Stewart Butterfield scrapping his mobile game company earlier arriving at Slack to Tobias Lütke using his online snowboarding shop's infrastructure to build the east-commerce platform Shopify.

These startups succeeded in scaling exponentially considering they were able to reach product-market place fit before ramping up sales and marketing. (What is dangerous is scaling prematurely before hitting product-marketplace fit, every bit virtually lxx% of startups do, co-ordinate to Startup Genome.)

Product-market fit can be difficult to measure out considering a product could exist anywhere from a few iterations to a significant pin away from achieving it. Withal, there are a few quantitative benchmarks that can show a startup'south progress.

A high Net Promoter Score (NPS), for case, shows that customers not only recognize the value of the product, but are willing to go out of their way to recommend it to other people.

Similarly, for affections investor Sean Ellis, product-market place fit can be reduced to the question, "How would y'all experience if you could no longer use [the production]?" The users who respond "Very disappointed" brand up the market for that product.

Another simple framework looks for strong superlative-line growth accompanied by high retention and meaningful usage.

Source: Brian Balfour

Strong production-market fit is a compelling sign that a startup volition become successful. VCs look for startups that have already achieved information technology or have a concrete road map toward it. Past the Series A stage, a startup generally needs to evidence investors that it has achieved or made visible progress toward production-market fit.

Founding squad

At the seed stage, a startup is goose egg more than a pitch deck. Josh Kopelman of Get-go Round Upper-case letter says that, at the seed phase, information technology's likely that a startup's product is wrong, its strategy is off, its team is incomplete, or it hasn't built the technology. In those cases, what he bets on is not the startup idea, but the founder.

When a VC invests in a startup, the VC is wagering that the visitor will go what Scott Kupor calls the "de facto winner in the space." VCs must therefore prudently decide whether a founding team is the best squad to tackle this market place trouble over whatsoever others that may come to them for funding at a later fourth dimension.

VCs look for founders with potent problem-solving skills. They ask questions to get a glimpse of how the founder thinks through certain bug. They get a sense of whether the founder has the flexibility to navigate through challenges, adapt to changes in the market, and even pin the product when necessary.

They also look for founders that have a coherent connection to the space they're looking to disrupt. Chris Dixon says that he looks at whether founders have industry, cultural, or academic knowledge that led them to their idea.

Emily Weiss, founder of Glossier, worked in fashion earlier launching the DTC beauty visitor. Airbnb's founders understood the culture of a generation willing to share homes and experiences. Konstantin Guericke, co-founder of LinkedIn, studied software engineering at Stanford earlier arriving at the idea that professional networking could be washed online.

VCs too favor founders who have previously founded unicorn startups. These founders have the experience of taking a company from zero dollars in revenue to billions, and they sympathize what information technology takes to transition the visitor at each level. They likewise have media coverage and a robust network — all contributing to recruiting talent and attracting resources.

For case, a grouping of early PayPal employees, called the PayPal Mafia, went on to start a number of highly successful startups, including Yelp, Palantir, LinkedIn, and Tesla. Other startup "mafias" — made upwards of early employees-turned-founders — go along to branch off from mature startups like Uber and Airbnb, in turn attracting additional VC attention and funding.

The term sheet

The term sheet is a nonbinding agreement betwixt VCs and startups about the atmospheric condition of investing in the company. It covers a number of provisions, the most important beingness valuation, pro rata rights, and liquidation preference.

Valuation

The valuation of the startup determines how much equity investors will ain from a certain amount of investment. If a startup is valued at $100M, a $10M round of investment will requite the investors x% of the company.

$100M would be the pre-coin valuation of the company — how much the company is worth before the investment — and $110M would be the post-money valuation.

A higher valuation allows the founder to sell less of the visitor for the same amount of money. Existing shareholders — founders, employees, and whatever previous investors — feel less share dilution, which means greater bounty when the company is eventually sold. Selling less of the company in a given investment round as well means the founder can raise more coin down the line while keeping the level of dilution in check.

All the same, a high valuation comes with high expectations and pressure level from investors. Founders who accept pushed investors to the brink of what they're comfortable paying volition have little room for mistakes. Each round generally needs to yield at least double the valuation of the previous 1, so a high valuation will also be harder to overshoot.

Another downside to a loftier valuation is that investors may veto moderate exits considering their pale in the company requires a bigger get out to be worthwhile. Investors may not allow a visitor with a valuation over $100M to exit for anything less than $300M, while they might exist okay with a lower-valued company beingness acquired for a more moderate sum.

Pro rata rights

Pro rata rights requite an investor the power to participate in time to come financing rounds and secure the amount of equity they ain.

If earlier VCs don't follow on in their investments, their shares get progressively diluted with each financing circular. If they endemic 10% of the company upon investment, they will lose x% of that initial buying each fourth dimension the startup offers upwards 10% to new investors.

Exercising previously secured pro rata rights can get a source of tension between early VCs that want to pitch in and protect confronting share dilution and downstream VCs who want to buy every bit much of the company equally possible.

Liquidation preference

The liquidation preference in a financing contract is a clause that determines who gets how much in the event that a visitor liquidates.

VCs, the preferred shareholders, are prioritized in the event of a payout.

A 1x multiple guarantees the investor will exist paid at least the investment master before others are paid out. The seniority construction determines the gild in which preferences are paid. "Pari passu" seniority pays all preferred shareholders at the same time, while standard seniority honors preferences in opposite gild, starting with the most recent investor.

As rounds get bigger and more investors become involved, a company should pay attention to managing its liquidation stack so that investors aren't disproportionately rewarded in a payout without leaving much behind for founders and employees.

The venture capital financing cycle: seed to get out

The average VC-backed startup goes through multiple rounds of funding in its lifetime.

At the initial or seed stage, most of the capital is allocated to developing the minimum viable product (MVP). Angel investors and the founder'due south friends and family frequently play a big role in funding the startup at the seed stage.

At the early on stages, capital is used for growth: developing the product, discovering new business channels, finding customer segments, and expanding into new markets.

At the later stages, the startup continues to scale revenue growth, although it may non nonetheless be profitable. Funding is generally used to expand internationally, acquire competitors, or prepare for an IPO.

In the final stage of the cycle, the company exits through a public offering or an M&A transaction, and shareholders have the opportunity to realize gains from their equity buying.

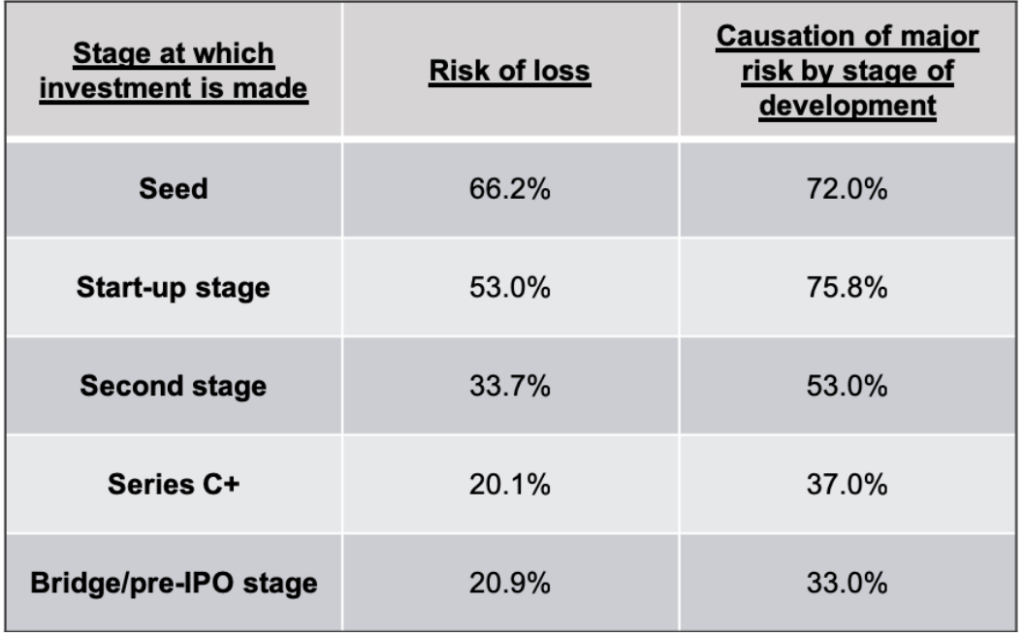

Seed- to early-stage investments are inherently more risky than late-stage investments, because startups at these stages don't yet take a commercially scalable product in place. At the same time, these earlier investments also generate college returns, as early on-stage startups with low valuations have much more room to grow.

Subsequently-stage investments tend to be safer because startups at this stage are normally more established. This isn't necessarily true in every case: Some technologies take longer to mature, and late-stage investors may all the same be betting on them to hit mass-market adoption.

Not all companies go along down this funnel. Some founders choose not to raise further rounds of venture capital, instead financing the startup with debt, greenbacks flow, or savings.

Ii big reasons founders choose to "bootstrap" are to maintain buying of the company's direction and build at a sustainable pace. Because venture upper-case letter comes with investor expectations that the visitor volition grow chop-chop month-to-month, VC-backed startups can fall into the trap of burning greenbacks for more customers.

This short-term pressure level to produce can lead startups to lose sight of their long-term creative vision. Recognizing this setback, founders of the video-sharing platform Wistia, for 1, chose to take on debt instead, writing in a blog postal service that they "felt confident that the profitability constraints the debt imposed would be healthy for the business."

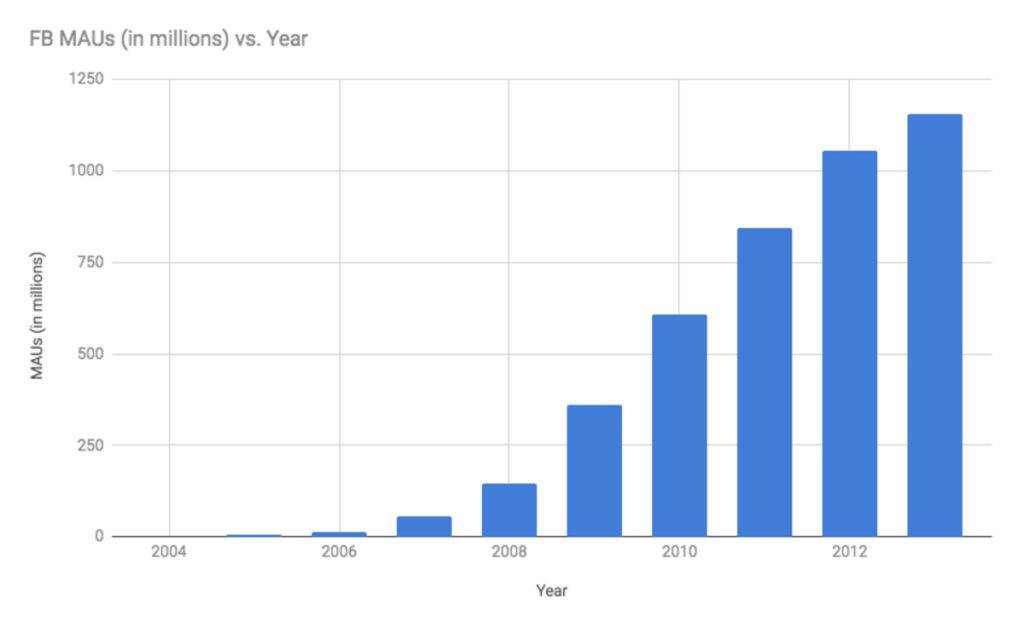

On the flip side, Facebook is an case of a company that has successfully scaled through diverse stages of the venture majuscule wheel. The startup's trajectory culminated in a $16B IPO at a $104B valuation, making information technology i of the nigh successful VC-backed exits of all time.

To some extent, Facebook's rise to the top seems inevitable. Its monthly agile users grew exponentially from 2004 to 2012, from just 1M to over 1B. In 2010, it surpassed Google as the most-visited website in the U.s., accounting for over 7% of weekly traffic.

But in the first few years of its founding, Facebook was considered overvalued. In 2005, Facebook's Series A $87M valuation was thought to be too high, and investor Peter Thiel chose not to follow on. In 2006, Facebook'due south users were still limited to 12M college students, and investors expected the service to fizzle out when information technology was released to a broader user base.

This section will encompass the basic objectives of each venture funding phase, while examining the specific steps Facebook took toward a successful go out that created billions in wealth for its investors.

Seed stage

At the seed stage, a startup is no more than the founders and the idea. The purpose of the seed circular is for the startup to figure out its production, marketplace, and user base.

As the product starts to proceeds more users, the company may then look to raise a Series A. However, most startups fail to gain traction before the money runs out, and stop up folding at this stage.

Seed-stage investments typically range from $250,000 to $2M, with a median between $750,000 and $1M. Angel investors, accelerators, and seed-phase VCs, such as Y Combinator, Outset Circular Majuscule, and Founders Fund, invest in these rounds.

When Facebook raised its seed circular, Peter Thiel, who had co-founded PayPal and had turned to angel investing, became the visitor's first outside investor, buying x.2% stake for $500,000. This put Facebook'southward valuation at $5M.

LinkedIn co-founder Reid Hoffman, who as well invested in the round, recalled that Zuckerberg was painfully quiet and awkward, with "a lot of staring at the desk" during their meeting. Nonetheless, Facebook's "unreal" user appointment levels on higher campuses tipped Thiel and Hoffman over the edge to invest.

Facebook used the funding to relocate to an function a few blocks away from the Stanford campus and hire more than 100 employees, many of whom were graduates of the college's engineering program.

Serial A

By the time a startup raises a Series A, information technology has developed a product and a business model to testify to investors that it will generate turn a profit in the long run. The purpose of fundraising in this circular is to optimize the user base and scale distribution.

Some startups skip the seed circular and starting time by raising a Series A. This tends to happen if the founder has established brownie, prior feel in the market place, or a product that has a high chance of scaling quickly with the right execution (e.g. enterprise software).

Series A rounds range from $2M-$15M, with a median of $3M-$7M. Traditional VCs such as Sequoia Uppercase, Benchmark, and Greylock tend to lead these rounds. While angels may co-invest, they don't have the power to set the price or impact the round.

Accel and Breyer Capital led Facebook's Series A in 2005, bringing its post-money valuation to nearly $100M.

At the time, Facebook was all the same limited to college students, with fewer than 3M users, while rival network Myspace had more than than four times that. Securing this second round of capital allowed Facebook to expand to i,400 colleges nationwide and improve the user feel with better features. While the full-calibration Facebook Ads platform wouldn't exist developed until 2007, Facebook began to experiment with sponsored links and banner ads at this stage.

Series B

By the fourth dimension a startup raises a Serial B, it volition have ideally established itself in a principal market and is looking to scale rapidly. It will use the money to ramp upwards sales and marketing efforts, expand geographically, and even learn smaller companies.

The size of Series B rounds tin can become upwardly of tens of millions. They are led by the aforementioned investors as Series A, and some later-phase firms, such as IVP, outset to get involved.

In 2006, Greylock Partners and Meritech Majuscule Partners joined in Facebook's $27.5M Series B. Past then, Facebook'south user base had grown exponentially to more than than 7M users. It ranked as the seventh most-visited website at this point.

Soon after the round, Facebook opened its website to the broader public, allowing anyone with a valid email accost to join. Open registration was a huge success, bringing the number of users from 9M in September 2006 to 14M in January 2007.

Series C

When a startup raises a Series C, it is often getting ready for K&A opportunities or for an IPO. The coin raised in this round will continue to finance its expansion efforts from its Serial B stage, including expanding geographically (fifty-fifty internationally), acquiring competitors, and developing new products.

A Series C can range from tens to hundreds of millions. Early-stage VCs may invest in this circular, only belatedly-phase investors, including private equity firms, hedge funds, late-phase arms of investment banks, and big secondary market place firms as well participate.

In October 2007, Microsoft bought a 1.half dozen% pale in Facebook for $240M, putting Facebook'due south valuation at $15B.

The bargain was a strategic partnership: Microsoft would sell Facebook's banner ads shown exterior the U.s.a. and split up the acquirement. Facebook used the upper-case letter to hire more employees, expand overseas, and launch Facebook Ads, a comprehensive advert platform for businesses of all sizes.

Late stage

By the time a visitor is raising tardily-stage rounds, information technology is usually looking to go public. Capital from late-phase investments is used to drive down prices, suppress competitors, and create favorable weather for an IPO.

In the by few years, many companies have been spending more fourth dimension at this phase, rather than moving frontward with an IPO. A number of tech unicorns, such as Postmates and Stripe, are all pending IPOs, despite posting billions in revenues.

Unfavorable market conditions coupled with easy access to individual capital are fueling the trend toward larger, later exits. The disappointing public market debuts of Uber and Lyft in 2019 have led big startups to reconsider their exit strategies. Larger venture funds and bigger rounds mean that they can afford to stay private longer and build bigger war chests.

In 2009, Facebook raised a $200M Series D round from the Russia-based internet company Digital Sky Technologies (DST), putting its valuation at $10B. Then, in 2011, Facebook raised $one.5B at a $50B valuation in a Series E circular with participation from DST and Goldman Sachs' venture arm.

Exit

During an IPO, a visitor that'south been funded by private investors sells public shares for the first fourth dimension. IPOs are frequently thought of as the ideal exit scenario, because founders proceed control of the company while shareholders relish loftier payoffs.

An alternative go out strategy is a merger or acquisition. Acquisitions tin also be highly profitable, but founders oft have to surrender control. For instance, Instagram was acquired by Facebook for $1B in 2012, but its co-founders left the company in 2018 when they couldn't encounter eye-to-middle with Mark Zuckerberg.

Facebook turned down many acquisition offers throughout the years, including a $1B offer from Yahoo! in 2006.

Zuckerberg floated the idea of an IPO in 2010, only at the time said the visitor was "in no rush." By 2012, Facebook had more 500 circular-lot stockholders, subjecting it to SEC disclosure rules despite its status as a individual company. Facebook took steps toward an IPO past buying upwardly smaller companies to enhance its offerings and solidify its foothold in the consumer internet space.

In May 2012, Facebook raised $16B in its IPO, putting the company'southward valuation at $104B and producing internet profits in billions for early investors like Thiel, Accel Partners, and Breyer Uppercase.

Facebook'due south continued success, however, would go on to make its IPO wait like a bargain. Equally its revenue continued to abound — from effectually $5B in 2012 to over $70B in 2019 — its stock cost also climbed, trading at over vi times its IPO price as of May 2020.

If you lot aren't already a client, sign upward for a free trial to acquire more about our platform.

boylesthemake1939.blogspot.com

Source: https://www.cbinsights.com/research/report/what-is-venture-capital/

0 Response to "How I d Approach General Assembly Again as a Vc"

Post a Comment